Berlin, Germany – A contentious debate is brewing at the heart of Europe’s largest economy as grid operators advocate for a radical overhaul of Germany’s electricity market. European transmission system operators (TSOs) have issued a compelling recommendation: carve Germany’s unified power price zone into as many as five distinct bidding areas. Their rationale? Maximizing economic efficiency, bolstering the security of energy supply, and ultimately driving down costs.

However, this proposition has ignited a fierce backlash from powerful southern state leaders and key industry groups, who vehemently oppose the split, fearing it will exacerbate already soaring energy costs and undermine the competitiveness of German businesses.

The TSO association, ENTSO-E, presented its findings in a comprehensive Bidding Zone Review. By modeling various configurations – splitting the current single zone (encompassing all of Germany and Luxembourg) into two, three, four, or five areas – their simulations consistently pointed towards significant economic gains compared to the status quo. Based on 2019 data and assumptions, ENTSO-E estimates that a five-way split could have yielded economic efficiency gains ranging from a staggering €251 million to €339 million this year alone.

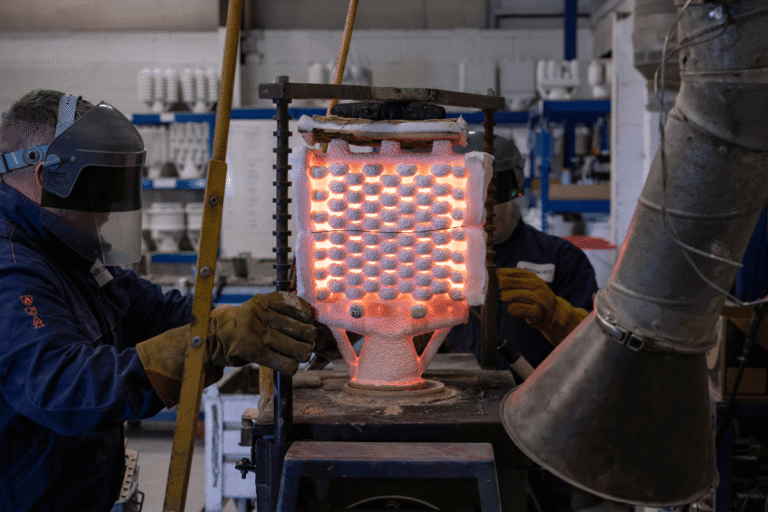

The logic behind the split is rooted in addressing the growing bottlenecks within Germany’s electricity grid. The country’s north boasts a high concentration of renewable energy generation, particularly wind power, while the industrial heartlands in the south grapple with substantial energy demand. The insufficient transmission capacity linking these regions forces grid operators to undertake increasingly expensive “redispatch” measures – curtailing renewable energy in the north and activating more expensive power sources elsewhere to maintain grid stability.

ENTSO-E argues that splitting the price zone would create localized price signals, incentivizing consumption closer to renewable generation and reducing the need for these costly interventions. This, they contend, would also facilitate the integration of more renewable energy into the grid.

Jan Rosenow, Vice President at clean energy NGO Regulatory Assistance Project (RAP), echoed this sentiment, stating on Bluesky, “Splitting Germany’s single price zone is long overdue. Right now, it drives generation and demand to the wrong places — making electricity more expensive for everyone.” Even neighboring Sweden has linked its support for a new transmission line to Germany with a restructuring of its electricity market.

However, the prospect of a divided energy market has sent alarm bells ringing in the south. Markus Söder, the influential head of Bavaria’s Christian Social Union (CSU), a key player in Germany’s likely next government, minced no words in his opposition. “Our country must not be divided,” he declared, emphasizing the economic strength of the south and west.

This resistance is strongly supported by influential industry associations. The BDEW (German Association of Energy and Water Industries) and the VDA (German Association of the Automotive Industry) issued a joint statement warning against “new uncertainties” that could drive up already high electricity costs, jeopardizing the competitiveness of German industries and impacting jobs and prosperity. They argue that Germany needs “reliability, planning security and affordable energy” above all else.

Adding to the complexity, electricity producers in the renewable-rich north also voice concerns about potentially lower revenues in a smaller, more localized market. Matthias Belitz of the chemical industry lobby group VCI painted a picture of years of disruption, stating, “A complete reorganisation of the electricity market would take many years and open up a new mega construction site. Considerable uncertainty for consumers and producers is the complete opposite of what we need in the current difficult situation and in view of the urgently needed transformation.” He called for a focus on rapidly eliminating grid bottlenecks instead.

Interestingly, the parties poised to form Germany’s next government have already expressed their rejection of splitting the unified power price zone in their coalition treaty, setting the stage for a potential clash with the European recommendations.

Despite the strong opposition, the economic realities of Germany’s energy transition are making the debate increasingly pressing. Grid balancing costs have ballooned in recent years, reaching a staggering €3.2 billion in 2023. ENTSO-E itself highlights that even with a split leading to a decrease in overall market welfare in their simulations, the cost savings from reduced redispatch would more than compensate for this.

Think tank Agora Energiewende further underscores the growing importance of this issue as Germany’s electricity system evolves to incorporate more flexible consumers like hydrogen electrolysers, electric vehicles, heat pumps, and storage facilities. These technologies will require price signals to incentivize consumption patterns that alleviate grid congestion.

The ball is now in the court of the German government, which has six months to respond to the TSOs’ recommendation. Should the member states fail to reach a unanimous decision, the European Commission will then have a further six months to make a final ruling.

The debate over splitting Germany’s power price zone is more than just a technical discussion about market design. It’s a fundamental clash between the economic imperatives of a transforming energy system and the concerns of established industries and regional powerhouses. The decision that Germany ultimately makes will have profound implications not only for its own energy future but also for the stability and efficiency of the wider European electricity market. The lines are drawn, and the energy world waits to see which path Europe’s economic engine will choose.